Routing Number 325181248

Checking —

More choices,

more perks

Whether you’re after everyday essentials, accounts that earn dividends, or all-in extras—there’s a checking account here for you.

Choose your smart fit

All three accounts come with the essentials: online and mobile banking, debit card, bill pay, and eStatements. From there, it’s all about what fits your lifestyle:

EarnSmart™

Checking

Earn more with minimal effort and a high dividend rate.

Fee waived with eStatements*

(otherwise $7/month)

Perks

| Anywhere Access | ⓘ |

| Earn 3.00% APY* | ⓘ |

Smart Pick

EarnSmart Perks™

Checking

Premium checking with a high dividend rate, built-in savings, and protection.

Unlocks all exclusive perks

$7 monthly subscription cost

Perks

| Anywhere Access | ⓘ |

| Earn 3.00% APY* | ⓘ |

| Shopping Perks1 | ⓘ |

| BaZing Fuel2 | ⓘ |

| Bill Negotiation3 | ⓘ |

| Roadside Assistance | ⓘ |

| Health Savings Card | ⓘ |

Protection

| Cell Phone Protection4,5 | ⓘ |

| Pet Care Services3 | ⓘ |

| Buyer’s Protection & Extended Warranty1,4,5 | ⓘ |

Peace of mind

| Financial Wellness3 | ⓘ |

| ID Theft Aid3,4,5 | ⓘ |

Everyday Smart

Checking

Simple everyday banking essentials to keep you moving.

Fee waived with eStatements*

(otherwise $5/month)

Perks

| Anywhere Access | ⓘ |

Getting started is simple

Follow these steps:

1

Pick your account

Choose the one that fits your lifestyle.

2

Tell us about you

We’ll ask for your phone, date of birth, and a few other details.

3

Fund your account

Add money and you’re ready to go.

4

Enjoy smart checking

From savings to support, it’s built for members first.

Live life. Earn more.

With EarnSmart™ and EarnSmart Perks™ Checking, your everyday spending can earn you more. Enroll in eStatements, set up a $200+ direct deposit, and make 15 debit card purchases each month to unlock 3.00% APY* on balances up to $5,000. That’s up to $150 each year!

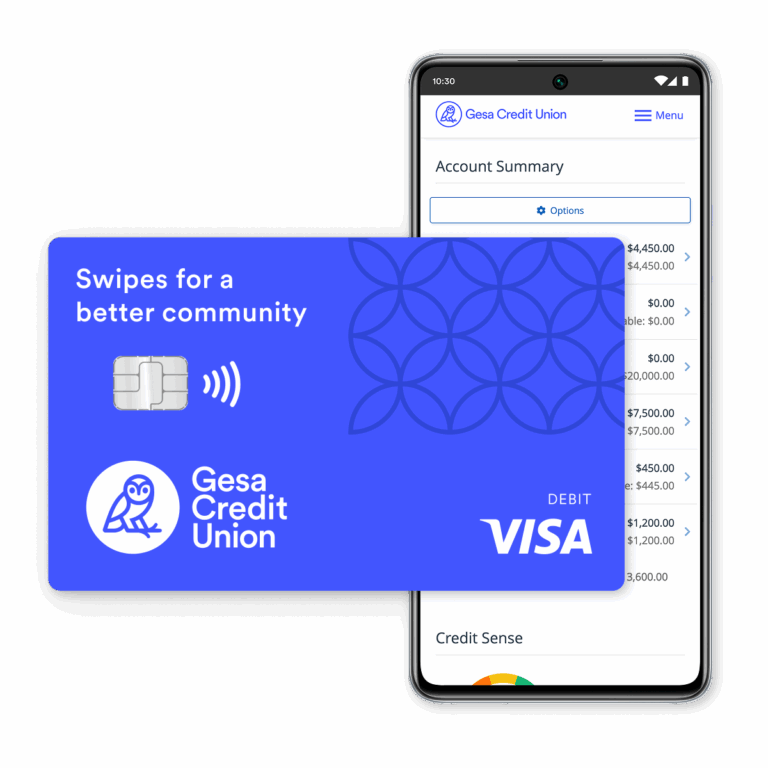

More value on day one

Your Gesa checking account delivers more value and more impact. Every time you use your debit card, Gesa donates to local heroes, schools, or nonprofits at no cost to you. You can even choose a debit card that directs our givebacks to the cause of your choice.

You’ll also get better savings rates, lower loan costs, and fewer fees, all from a credit union that puts members first. If you live in Washington or in select counties in Idaho or Oregon, joining is easy.

Once you’re a member, you stay a member, even if you move.

Digital tools that save time

With Gesa’s simple-to-use digital tools, you can lock or unlock your debit card instantly, set travel notices, and receive custom alerts for your transactions. Transfers are quick and seamless—whether you’re moving money between your Gesa accounts or linking to another bank. You can also enable Round-Up savings to grow your balance without needing to think about it.

Rest assured, knowing your money is protected. Our secure eStatements and tax documents keep everything you need in one easy-to-access location.

Ways to pay

You don’t need to carry your debit card to make secure payments. Add your Gesa debit card to a digital wallet for faster, easier checkout in-app, in-store or online.

A Smarter Way to Give Back

When you bank with us, you keep your money in your community and give back to local schools and organizations.

Total giveback in 2024

0

M+

Local Heroes grants awarded

0

+

Student-run branches

0

Volunteer hours since 2022

0

+

Recognized

for putting

members first

FAQs

Not sure which account to choose? Start with what matters most to you.

If you want a simple, low-cost account for everyday banking, Everyday Smart covers the basics—no monthly fee when you enroll in eStatements or set up recurring direct deposit.

If you’re looking to earn more, EarnSmart™ pays 3.00% APY* on balances up to $5,000 when you meet three easy monthly steps: eStatements, a recurring $200+ direct deposit, and 15 debit card purchases.

If protection and peace of mind are your priority, EarnSmart Perks™ builds on the credit union tradition of looking out for members. It adds premium benefits like cell phone protection, roadside assistance, ID theft restoration, and shopping discounts—all designed to safeguard your everyday life and your family.

Still unsure? Start with Everyday Smart and upgrade anytime. Or visit a branch—we’ll help you find your best fit.

At credit unions like Gesa, you’re a member, not just a customer—so instead of paying you interest like a bank, we pay you dividends as your share of earnings. Functionally, they work the same: it’s money you earn on your balance. The name just reflects our member-first structure.

With early direct deposit, your paycheck can show up in your account up to two days before payday—no extra steps needed. It’s automatic when you set up direct deposit with your employer.

Turn everyday spending into effortless saving. When you enroll in Round-Up, we’ll round your debit card purchases to the next dollar and transfer the difference to your savings account. Buy a coffee for $3.50? We’ll move $0.50 to savings—easy.

A mobile wallet lets you pay with your phone instead of your card. Add your Gesa debit or credit card to Apple Pay, Google Pay, or Samsung Pay, and you’re ready to tap and go—securely and contact-free.

Use our Card Manager tool to set spending limits, freeze or unfreeze your card, and get real-time alerts. It’s built into our mobile app, so you’re always in control.

Yes. All Gesa deposits are federally insured by the NCUA up to at least $250,000, so your money is safe and secure.

Absolutely. With online and mobile banking, you can check balances, transfer funds, deposit checks, and more—24/7, from anywhere.

They do. Every time you use your Gesa debit card, we donate to local schools and community causes. You spend, we give—it’s that simple.

Absolutely. If you’re already a member, you can switch to one of the new accounts by visiting a branch, calling us, or sending a secure message through online banking. We’ll help you make the move with minimal disruption.

Overdraft protection is a financial service that helps prevent transactions from being declined due to insufficient funds, to avoid fees and potential service disruptions in service.

Gesa offers many other services to help members accomplish their financial goals, such as Cashier’s Checks, Safe Deposit Boxes, Savings Bond Redemption, and Notary Service.

Disclosures:

EarnSmart Perks™ Checking

*APY (Annual Percentage Yield) is accurate as of , the last dividend declaration date. EarnSmart Perks checking accounts earn APY on the first qualified $5,000 in balances. Amounts over $5,000 earn 0.01% APY. In order to earn APY on the first $5,000 and receive unlimited domestic ATM fee refunds, you must meet the following requirements during each monthly qualifying period: provide and maintain valid email address, apply for and use your Visa® debit card to make 15 debit card transactions that post and settle to your account, have at least one direct deposit of $200 or more post to your account, and enroll to receive eStatements. If the requirements are not met during the monthly qualifying period, the “non-qualifying” 0.01% APY will apply to the entire balance. The EarnSmart Perks Checking account provides subscription benefits with a $7 monthly subscription cost. There is a minimum opening balance of $25 required if the account is opened online. Rates, terms, and fees are subject to change at any time after account opening. Fees may reduce earnings.

Overdraft protection options are available for EarnSmart Perks Checking accounts.

EarnSmart™ Checking

*APY (Annual Percentage Yield) is accurate as of , the last dividend declaration date. EarnSmart checking accounts earn APY on the first qualified $5,000 in balances. Amounts over $5,000 earn 0.01% APY. In order to earn APY on the first $5,000 and receive unlimited domestic ATM fee refunds, you must meet the following requirements during each monthly qualifying period: provide and maintain valid email address, apply for and use your Visa® debit card to make 15 debit card transactions that post and settle to your account, have at least one direct deposit of $200 or more post to your account, and enroll to receive eStatements. If the requirements are not met during the monthly qualifying period, the “non-qualifying” 0.01% APY will apply to the entire balance. For EarnSmart Checking accounts, the $7 monthly service fee will be waived if you enroll to receive e-statements; or have recurring payroll or benefit direct deposit of $200 or more during the qualifying period. There is a minimum opening balance of $25 required if the account is opened online. Rates, terms, and fees are subject to change at any time after account opening. Fees may reduce earnings.

Overdraft protection options are available for EarnSmart Checking accounts.

Everyday Smart Checking

There is a minimum opening balance requirement of $25.00 if the account is opened online.

For Everyday Smart Checking accounts, the $5 monthly service fee will be waived if you enroll to receive e-statements; or have recurring direct deposit during the qualifying period.

Overdraft protection options are available for Everyday Smart Checking accounts.

- Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions, and may choose to limit deals.

- You’ll receive a one-time activation reward of $0.10 per gallon when you activate BaZing Fuel. You’ll earn a monthly reward of $0.10 per gallon each month when you have 15 eligible debit card transactions post and settle during the Monthly Qualification Cycle (MQC), which is defined as the first day of the month through the last day of the month. Only transactions posted during the MQC will count towards the monthly reward for that MQC. The following activities do not count toward earning BaZing Fuel: ATM withdrawals, transfers between accounts, deposit or refund transactions. Transactions posted during the MQC greater than the monthly reward requirement will be stored to count towards a bonus reward of $0.10 per gallon. When you have 50 stored bonus transactions you will earn the bonus reward. You will continue to earn bonus rewards for every 50 stored bonus transactions accrued. If the required monthly reward transaction count is not met during the MQC, no transactions are counted for any reward during that MQC or the bonus reward. BaZing Fuel is limited to 20 gallons of fuel per purchase, per vehicle, or fraud limits placed by Shell and/or limits placed on your payment card by your financial institution, each of which may be lower. To activate, you will need to have online banking with your financial institution. Refer to the BaZing Fuel Terms and Conditions for full disclosures at strategycorps.com/bazing-fuel-terms-and-conditions. BaZing Fuel offer may be changed at any time and without notice.

- Requires additional activation to begin.

- Subject to the terms and conditions detailed in the Guide to Benefits.

- Insurance products are: NOT A DEPOSIT. NOT NCUA-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE CREDIT UNION.

Routing Number: 325181248

51 Gage Blvd. Richland, WA 99352

Federally insured by NCUA

Equal Housing Opportunity

Co-op Shared

Branch

© Gesa Credit Union. All Rights Reserved.

Copied to clipboard

You are leaving gesa.com

We are redirecting you to an external website

You are being redirected to a site that is not operated by Gesa Credit Union.

Gesa is not responsible for the content of the site, nor does Gesa represent the site or the Gesa member if the member decides to act upon or enter into a transaction with the site.

Privacy and security policies of the site may differ from those of Gesa Credit Union.

Getting started is easy!

Tens of thousands of members across the Northwest have applied online–it’s fast, secure, and only takes a few minutes.

Need help? Call (888) 946-4372 or stop by any branch.

Switching Is Simple

Members like you can move to our new suite of Smart Checking accounts in minutes

Call (888) 946-4372 or stop by any branch.

Facing an unexpected financial emergency?

We offer a range of relief options to ease short-term stress and support you.

People helping people.

Gesa credit union is committed to making a positive impact in the communities we serve.

All debit cards give back to your community

when you swipe.

when you swipe.

We’re in the business of growing yours.

We have the accounts, products, and services to help you and your small business succeed.

Banking made

for you.

for you.

With best-in-class rates and a variety of everyday banking products, Gesa has the right account, card, or loan for you.

We have upgraded to a new account opening process. Click Get Started to continue.

Getting started is easy!

Applying should only take a few minutes. Please have these documents ready:

- Social Security Number (SSN)

- Color copy of driver's license, state ID, or US Passport

- Contact info

-

Opening deposit by debit card or e-transfer*

*Credit cards are not accepted.

Call (888) 946-4372 or apply at a branch

Already a member?

Use your online banking log-in to pre-fill your application with saved information.

You can easily change your debit card through our affinity form.

Notes & Fees Glossary

| Disclaimer | ||

|---|---|---|

| SmartPlus Checking | [APY] Minimum opening balance of $25 required if the account is opened online. In order to earn APY and receive unlimited domestic ATM fee refunds, you must meet the following requirements during each monthly qualifying period: provide and maintain valid email address, apply for and use your Visa debit card to make 15 debit card transactions that post and settle to your account, have at least one direct deposit of $200 or more post to your account, and enroll to receive eStatements. If the requirements are not met during the monthly qualifying period, the “non-qualifying” 0.01% APY will apply to the entire balance. Dividends on a SmartPlus Checking account will be compounded and credited to a member’s account each month. Dividends are calculated using the daily balance method. Qualifying account balances must meet minimum requirements. Rate may change after the account is opened. The qualifying period begins with the first day of the calendar month and ends on the last day of the calendar month at 6:00 P.M. Pacific Time. ATM fees of $4.99 or less will be reimbursed up to a maximum of $4.99 per individual transaction. No monthly fees and no minimum balance required to open or maintain account unless opened online. Fees could reduce earnings on the account. Limit of one SmartPlus Checking account per member. APY is accurate as of , the last dividend declaration date. | A7KD4W9LQXZT |

| Smart Checking | *There is a minimum opening balance requirement of $25.00 if the account is opened online. Regular users of Gesa’s electronic services may want to consider SmartPlus Checking for additional benefits. [Courtesy Pay] | M3VY82CNRLKP |

| Student Checking | [APY] Dividends on Student Checking Accounts are calculated using the daily balance method and will be credited to the member’s account every month. Rate may change after the account is opened. If you close your account before dividends are paid, you will not receive the accrued dividends. The minimum balance to open an account is $5.00, the par value of a share. Courtesy Pay is not offered on Student Checking Accounts. Only electronic transactions such as debit card or ACH transactions are permitted. Fees could reduce earnings on the accounts. | JXZ7V5MWLQ92 |

| Smartplus Savings | [APY] In order to earn a high dividend rate, you must meet the following requirements during the qualifying monthly period: a) provide and maintain a valid email address; and b) be enrolled to receive e-statements. If the requirements are not met during the monthly qualifying period, the “non-qualifying” 0.01% APY would apply to the entire balance. Dividends on an SmartPlus Savings Account will be compounded and credited to a member’s account each month. Dividends are calculated using the daily balance method. Qualifying account balances must meet minimum requirements. Rate may change after the account is opened. The qualifying period begins with the first day of the calendar month and ends on the last day of the calendar month at 6:00 P.M. Pacific Time. No monthly fees and no minimum balance required to maintain account. Minimum opening deposit of $5. Fees could reduce earnings. Limited to one SmartPlus Savings account per member. | P9T6QF2XJBLC |

| Smart Savings | [APY] Dividends on Smart Savings are calculated using the daily balance method and are paid monthly. Rate may change after the account is opened. No monthly fees and no minimum balance required to maintain account. Minimum opening deposit of $5. Fees could reduce earnings on the account. | Y4MKZ3WVTPQ8 |

| High-Yield Savings | [APY] Dividends on the High Yield Savings account are calculated using the daily balance method and are paid monthly. No monthly fees and no minimum balance required to maintain account. Minimum opening deposit of $5. Fees could reduce earnings. | NDLXQ98R5VTE |

| Money Market | [APY] Dividends for the Money Market Account are calculated using the daily balance method which applies a daily periodic rate to the balance in the account each day. You must maintain a minimum daily balance of $2,500.00 in your account each day to obtain the disclosed annual percentage yield. The minimum balance required to open this account is $2,500.00. There is a minimum average daily balance of $2,500.00 required to avoid a service fee for the calendar month. If the minimum average daily balance requirement is not met, you will be charged a service fee as stated in the Consumer Fee Schedule. New rates are set on the first of each month; rate may change after the account is opened. Fees could reduce earnings on the account. | GQ37ZVKY1WLM |

| Fixed Certificate | [APY] A penalty may be imposed for early withdrawal. Fees may reduce earnings. The minimum balance to open the certificate is stated in the chart. Early withdrawal penalties apply (a penalty may be imposed for withdrawals before maturity): If your account has an original maturity (term) of less than 12-months: The penalty will equal 90 days interest on the amount withdrawn subject to penalty. If your account has an original maturity (term) of 12-months or more – up to, but less than 36-months: The penalty will equal 180 days interest on the amount withdrawn subject to penalty. If your account has an original maturity of 36-months or more – up to, but less than 48-months: The penalty will equal 365 days interest on the amount withdrawn subject to penalty. If your account has an original maturity of 48-months or greater: The penalty will equal 540 days interest on the amount withdrawn subject to penalty. In certain circumstances such as the death or incompetence of an owner of this account, the law permits, or in some cases requires, the waiver of the early withdrawal penalty. For any account which earns an interest rate that may vary during the term such as a bump certificate, the interest rate we will use to calculate this early withdrawal penalty will be the interest rate in effect at the time of the withdrawal. You may make withdrawals of principal from your account before maturity. In making such withdrawals, your balance may not fall below the minimum or we will close your account. Principal withdrawn before maturity is included in the amount subject to early withdrawal penalty. You can withdraw interest only on the crediting dates without penalty. A $500 minimum deposit is required for consumer, IRA, and business certificates. Early withdrawal penalties may apply and may reduce earnings. Certificate rate is for a limited time only and could end at any time. Stated rate as of the first day of the month. | H85PLKJXZ2QM |

| Bump Certificate | [APY] A penalty may be imposed for early withdrawal. Fees may reduce earnings. The minimum balance to open the certificate is stated in the chart. The Certificate owner must contact Gesa Credit Union to request the one-time rate increase on Bump Certificate accounts. The rate on the Bump Certificate will be changed on the following business day of the date Gesa Credit Union receives the request. The bump option can only be exercised once during the term of the Certificate and does not increase the term of the certificate. The new interest will not be applied retroactively. The new interest rate will be the interest rate we are then offering on regular certificates (non- bump rate certificates) that have the same term and minimum balance. Bump Certificates are only available for consumer and IRA Certificates. Early withdrawal penalties will apply. Minimum deposit balance must be maintained to earn APY and fees may reduce earnings on the account. Special offer for a limited time only. | RXNQ72MLYV9C |